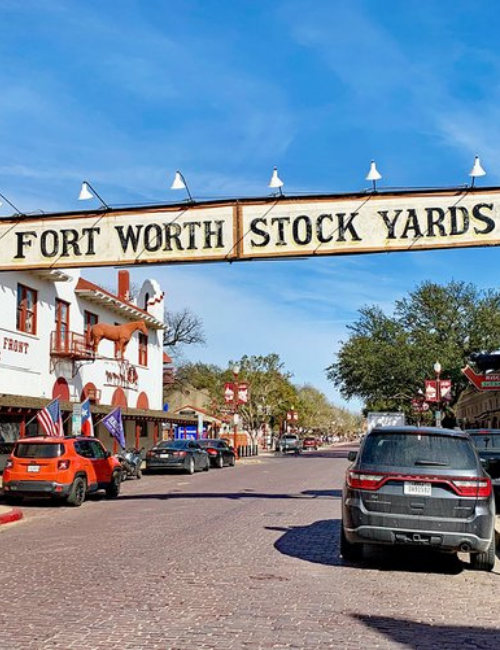

Fire-damaged house sales in Fort Worth, TX, can be fast and profitable with the right approach. To navigate the local market, you need to know what works for quick sales and efficiency. Pioneer Home Buyers can simplify the selling process by assessing damage and finding eager cash buyers who love Fort Worth homes’ vibrant charm. This guide provides essential tips to make your transaction go smoothly and turn a difficult situation profitable. Learn how to sell your fire-damaged home quickly today.

Brief Overview

To overcome obstacles and maximize return, selling a fire-damaged Fort Worth, TX house requires strategic planning. Evaluate fire damage, understand its impact on property value, and decide whether to sell as-is or repair. Avoiding repairs by selling as-is to sell your house fast for cash in Fort Worth and nearby cities speeds up the process. Without bank financing, cash buyers offer faster, smoother transactions. Compliance and a smooth transaction depend on legal requirements, including damage disclosure. Knowledgeable professionals and local market insights can help sell.

Key Highlights

- Effective selling strategies require fire damage assessments, including structural damage.

- To attract cash buyers in Fort Worth’s competitive market, sell as-is to avoid costly repairs, time, and stress.

- Cash buyers eliminate loan approvals and negotiations, speeding up the sale.

- Repair costs, market conditions, and the need for a quick sale determine whether to sell as-is or repair.

- Avoid fire-damaged home post-sale disputes by following Texas law, including property disclosures.

Understanding the Challenges of Selling a Fire-Damaged House

Challenges fire-damaged houses pose in Fort Worth, TX, can be multifaceted, stemming from the physical damage, subsequent limitations, and effects on the overall value of the property. Many homeowners lack sufficient experience in damage restoration, and estimating the impact of fire damage on the real estate market can be quite complicated. Upon critical evaluation, fire damage and its influencing factors on the overall market price of your property. An in-depth understanding of these components ought to help in the successful selling of your fire-damaged house.

Assessing the Extent of Fire Damage

Before listing your home for sale, you must assess the fire damage. This includes ascertaining any damage that is not visible. Assessing the damage is crucial for determining the potential restorations of the home and the market value. Concerns about smoke damage must also be addressed since it can pose a serious health risk.

Employing a damage inspector is a professional and reliable course of action. They will assess any damage, both external and internal, and will also identify any damage caused by smoke and soot that is otherwise undetectable. Having a full understanding of the fire damage provides homeowners with information crucial to making decisions about the scope of repairs, the potential risks, and the overall fire damage to the home, thus explaining the value.

After the damage is assessed, the processes concerning whether the homeowner sells the home as-is or performs repairs will be considered. Many times, there will be a potential profit, but it will be outweighed by the cost of the repairs. Knowing the damage gives time to the seller, encourages a potential sale, relieves stress, and allows the home to be sold as is. This is imperative for selling homes that have sustained fire damage in Fort Worth.

Impact on Property Value

The market value of a home decreases with fire damage and can drop as much as 50% depending on the damage and repairs needed. Homes that have been fire damaged can be seen as a risk and even a dangerous buy, as people tend to be scared of restoration costs and losses, structural safety, and the home overall being unsafe. This makes selling the home at a market value almost impossible.

Restoration cost impacts property value immensely. Extensive damage with high repair costs means a lot of risk concerning a loss, and many buyers, especially first-time buyers, will step far away. Cash buyers and seasoned investors will be different since most of them have the means to do a quick restoration and will view the fire-damaged home as an opportunity.

The perceived risk of valuation can be as significant as the actual risk. Buyers tend to think of hidden damages, loss of liability, and even loan issues and pay much less. In Fort Worth, local conditions of the market will have the most impact on the value. Having knowledgeable people will make the value assessment easier and help determine the right selling method.

Benefits of Selling a Fire-Damaged House As-Is

If you are hawking a fire-damaged house without doing repairs, there are still benefits you will enjoy. Selling a house without repairs will mean a lower price will need to be set, and without repairs, this will help you not waste time trying to repair the house. Houses in this condition can reduce repair time and attract buyers interested in house flipping. In this part, we will help you see that buyers doing house flipping will help lower your time for repairs and will help you get a lower value for the house. This will help buyers who are more interested in house flipping and not trying to get value for the house.

Avoiding Costly Repairs

Selling a home and property damaged by fire “as-is” means the homeowner does not have to take the burden of doing the repairs. The damage includes structural repairs, burned wiring, soot, smoke, and other expensive, situational issues. The sellers deal with none of this by taking the as-is option, which costs them much less. Even repairing the damage is a lot less work in stress and time, not to mention the coordination of desperate contractors and the assignment of overall structural work to repair the burned buildings, which is highly time-consuming.

Finally, this means sellers and property owners avoid the risks of hidden damage that come with repair work and also avoid the overexpenditure that piles up in overall costs when selling a home that needs repairs. Cash buyers and investors also take on post-purchase repairs and make additional improvements to the house. This way, the sellers do not have to do any of that extra work. It is for these reasons that people looking to purchase property in an as-is way focus mostly on the property in the as-is way.

| Benefit | Description | Impact | Target Buyer |

|---|---|---|---|

| Quick Sale | Eliminates the need for repairs and renovations. | Expedited transactions and quicker closures. | Buyers are interested in value-add opportunities. |

| Saves Money | Avoids upfront repair costs and allows for a direct pricing strategy. | Reduces financial outlay and increases net proceeds. | Buyers interested in value-add opportunities. |

| Accessibility | Opens opportunities for non-traditional buyers. | Broader market reach through diversified potential buyers. | Flippers and developers seeking project properties. |

| Reduced Stress | Simplifies the selling process by removing renovation complexities. | Minimizes emotional and logistical burdens on owners. | Individuals looking for hassle-free transactions. |

This table shows how selling fire-damaged properties as-is benefits cash buyers and market trends.

Speedy Transaction Process

The primary disadvantage of selling a fire-damaged house as-is is that it involves a fast transaction. Sellers can skip the stage of assessing the damages, coordinating the repair, and waiting for the repairs to be completed and move straight into the negotiations phase, where a seller has already moved to negotiation with buyers. This is ideal for the sellers who are trying to relocate quickly or need quick immediate access to money.

Most of the as-is buyers are cash buyers, which makes the closing of the seller’s payment very quick. They skip the mortgage approval, the repair contingencies, and the repair inspections, closing the deal as quickly as a week. This closing is faster than the waiting period most sellers and buyers are used to and is ideal for a seller who recently suffered a house fire, needing the funds to help counter the mental and financial stress fire causes.

Also, selling as is makes negotiation much easier, as there is no negotiation over repair credits or final inspection repairs needed to be done, as all homes are taken in the state they are in. This factor makes selling as-is very smooth and complication-free. In the competitive market of Fort Worth, cash buyers are sellers’ best option to make the deal, as fire-damaged houses are stress-free for sellers.

Why Cash Buyers Are Best for Fire-Damaged Properties

The process for selling a fire-damaged house can be a difficult task to tackle. However, cash buyers can help ease that effort while still providing a seller with adequate rewards. Often, cash buyers are real estate investors who are willing to buy any property, regardless of whether it has been damaged by fire or not. In the following sections, the benefits to the seller dealing with cash buyers will be examined in detail. Finally, providing the seller with these tools can help position homeowners with fire-damaged houses for a more successful transaction.

Understanding The Benefits of Selling to Cash Buyers

The first advantage of selling a house to cash buyers for a fire-damaged property is that they often overlook the costly repairs typically required for damaged homes. Unlike traditional buyers, cash buyers purchase houses as is, eliminating the need for renovations. This is especially valuable with fire-damaged homes, where repairs can be extensive, time-consuming, and expensive. From charred walls and ruined flooring to hidden smoke or water damage, the ability to sell without making repairs provides significant relief for the seller.

The completion time for a cash sale is another of their benefits. Unlike traditional transactions, which can take a few months to use for mortgage approvals and contingencies, cash buyers take a few days to a week for completion. This is especially key in a fire-damaged property situation where the homeowner is looking to recover and manage their finances quickly.

Cash buyers also bring more certainty and uncomplicated negotiations. The buyers have funds on hand to purchase a home and remove the risk of a deal falling through. They inspect homes, take as-is offers, and typically forgo lengthy inspections and contingencies. The offers they present are fair to the home and honest about its condition. Engaging cash buyers under Fort Worth’s current selling circumstances can make selling a fire-damaged home a smooth sale.

The Role of Cash Buyers in Streamlining Processes

The role of cash buyers in buying fire- and smoke-damaged houses can be a deal-changer, as they simplify the intricacies that come with the traditional sale of a house. They value the property with no need for bank evaluations, as they do not need bank approvals and insurance evaluations, which are typically complicated for fire-damaged homes. This boosts transaction certainty by circumventing the uncertainty that orders financing transactions.

Sellers no longer have to do extensive staging or repairs, which are usually burdensome and costly. Cash buyers are not like traditional buyers, as they do not focus on the current property condition, enabling the seller to sidestep costly improvements. Also, with distressed properties, they streamline the unsophisticated and monotonous processes of evaluations and appraisals for pricing with a focus on fair pricing, thus avoiding the archaic processes of pricing and counterpricing.

The nature of cash deals also speeds up the transaction, involving fewer contingencies and enabling a much quicker closing. This is especially valuable in markets like Fort Worth, where efficiency matters and cash deals frequently close well ahead of standard timelines. In situations where selling a damaged home can feel complicated and overwhelming, cash buyers make the house sale by owner process significantly simpler and more stress-free for the seller.

Strategies to Sell Damaged Homes in Fort Worth

The various options available for selling a fire-damaged house in Fort Worth provide the homeowner with thoughtful considerations for each route. From a profitability perspective, selling a house for the most value possible requires the homeowner to understand the various options available for selling the house in the least amount of time. Moving on to the selling strategy, the homeowner must understand the multiple options for selling the house as-is, for repairs, or for a combination of repairs and selling as-is. This guide provides multiple pathways in Fort Worth that sell fire-damaged houses to work on the various options available to sell the house quickly and smartly.

Choosing Between As-Is and Repair Alternatives

When deciding how to sell a fire-damaged house, a homeowner must choose between selling the property as-is or making some repairs. This option could appeal to property renovators and cash buyers in Fort Worth, who would save time and money by selling as-is. Such buyers look to acquire properties for restoration and resale. This option would ease the sale, as there would be no need to invest time, money, or effort in repairs.

On the other hand, making repairs before selling a property will certainly increase the market value, which in turn will help sell to a wider range of buyers. This, however, will need a bit more work to analyze whether the majority of the repairs will be counterbalanced or justified by a sale price. For example, if repairs will be minor and inexpensive, then of course they will pay. Extensive fire damage, however, will certainly make selling as-is the more practical option.

Considerations of timing and finances will be primary in making a decision. Selling as is will mean faster transactions, which benefits homeowners under financial distress or who need to sell to relocate. Cash buyers will speed up the sale, as they will not need to wait for financing approval. With the Fort Worth market in mind, local real estate professionals will be a good choice for impacted homeowners to help ease the decision-making.

Understanding Different Selling Strategies

It is necessary to determine a strategy for each fire-damaged property for sale. Selling to a cash buyer is usually quick and easy. Cash buyers do not need to wait for financiers and are less likely to back out of a deal, streamlining the selling process. Consequently, there is certainty and speed for the seller when a cash buyer is involved. Cash buyers are usually quick and easy.

Selling to investors who purchase distressed properties is a second option. Fire-damaged properties are not a loss for such buyers. Investors hope to rehabilitate fire-damaged homes and appreciate the potential for long-term returns. Attracting such buyers is usually easy when showing data and comparable market trends, especially when the data presentation is straightforward.

For a seller doing a traditional listing, the property is relisted as a fire damage restoration specialist. Selling the property after it has been strategically repaired to improve safety and aesthetics is easier, and the sale price is likely to be higher. In addition, online advertising, along with quality photos and virtual tours, will help reach buyers throughout the Fort Worth area, making this sale go from a costly challenge to a beneficial opportunity.

Legal Considerations in Selling an Estate in Texas

Selling any estate in Texas, particularly fire-damaged ones, requires an understanding of compliance issues and other legal factors to facilitate smooth transactions. Important issues include property disclosure and local laws governing the real estate transaction. Homeowners can expedite the transaction with cash home buyers in Texas and adjacent towns by understanding these issues.

Real Property Disclosure Requirements

Real estate transactions in Texas require property disclosure to protect sellers and buyers by disclosing the property’s condition. A Seller’s Disclosure Notice must disclose all known issues when selling a fire-damaged home. Sellers must list structural damage, repairs, and defects that affect property value or habitability in this legal document. Not disclosing fire damage issues can lead to lawsuits or financial liabilities after the sale.

Disclosure should include the extent of fire damage and repairs completed or needed. Roof damage, wall damage, and smoke or soot are structural issues. Sellers should also list fire damage insurance claims, outcomes, and unresolved issues. Transparency improves buyer trust, reduces renegotiations, and streamlines transactions by clarifying repair needs.

Foundation, electrical, mold, and asbestos issues are also required to be disclosed to buyers. Full disclosure reduces legal risks and post-sale issues. Consult legal or real estate professionals familiar with Texas property laws to complete forms and convey all necessary information, making the sale of a fire-damaged Fort Worth house legal and efficient.

Navigating Local Regulations

Selling any home, especially Fort Worth fire-damaged ones, requires knowledge of local laws. From repair permits to environmental standards, local laws can affect the sale. Fort Worth requires significantly fire-damaged properties to meet structural integrity and safety codes, including inspections. Permits are needed for pre-sale repairs to avoid fines, legal issues, and delays. Clearance reports from certified professionals for smoke residue or chemical contamination cleanup provide reassurance to buyers and authorities.

Also important is insurance and tax knowledge. Local tax advisors can help plan for fire-damaged properties’ reduced value and reassessed property taxes. Legal advice is essential for complying with Fort Worth laws and preparing all necessary documents. Hiring a real estate attorney or consultant to help sell a fire-damaged home can save time and ensure compliance with local laws, ultimately facilitating a faster sale.

Selling fire-damaged properties in Fort Worth requires understanding and following local regulations. Here are key steps to ensure compliance and streamline the sales process:

- Learn Fort Worth’s structural safety codes and inspection requirements.

- Before starting repairs, get permits to avoid fines and legal issues.

- Environmental cleanup professionals should be certified and provide clearance reports.

- Fire damage may require property tax reassessments. Consult local tax advisors.

- Hire a lawyer to understand regional laws and prepare paperwork.

- Maintain transaction timelines by proactively addressing compliance issues.

- Consult a Fort Worth real estate expert for customized advice.

Following these steps will make Fort Worth property sales more compliant and efficient.

Sell a Fort Worth fire-damaged house quickly and transparently with a flexible strategy. By highlighting the property’s potential and pricing it competitively, sellers can attract cash buyers willing to renovate. Working with cash home buyers simplifies the sales process and eliminates obstacles. Leveraging local knowledge and fire-damaged property marketing strategies accelerates the closing process for quick and easy home sales. Contact Pioneer Home Buyers today.

Need to sell a fire-damaged house fast? Pioneer Home Buyers offers fair cash deals, handles all the details, and makes the process easy. Call (817) 382-1155 for a no-obligation offer today.

FAQs

How do Fort Worth homeowners sell fire-damaged homes?

A thorough fire damage assessment must identify both visible structural damage and invisible smoke-related issues. Expert inspectors can provide detailed damage reports for informed decision-making.

Why sell wildfire-damaged homes as-is?

Sales as-is avoid the financial and logistical hassles of repairs. Cash buyers prefer this method because it saves sellers time and money on restoration.

What kind of buyers prefer an as-is fire-damaged house?

Cash buyers and investors who can assess the potential value post-restoration are ideal. Repairing properties is their specialty, and they like flipping or upgrading them.

What laws must Texans who sell fire-damaged homes follow?

Texas law requires full property disclosure. Fire, smoke, structural, and insurance claims must be disclosed in a Seller’s Disclosure Notice. Transparency avoids post-sale lawsuits.

Does Fort Worth’s market affect fire-damaged home sales?

Local markets affect fire-damaged property appeal. Low inventory may increase interest in such properties in a competitive market. They may have trouble selling in a slow market.

Helpful Fort Worth Blog Articles

- How to Sell a House in Probate in Fort Worth, TX

- Can You Sell a House in Foreclosure in Fort Worth, TX?

- How to Sell a Fire-Damaged House in Fort Worth, TX

- How to Do a Sale by Owner in Fort Worth, TX

- Can You Sell a House with Tenants in Fort Worth, TX

- Is Fort Worth, TX, a good place to live?

- Fort Worth, TX Neighborhood Map

- Fort Worth, TX Capital Gains Tax Calculator

- Fort Worth, TX Cost of Living: Is It Affordable?

- Best Fort Worth, TX Property Managers

- Best and Worst Neighborhoods in Fort Worth, TX

- Fun Facts about Fort Worth, TX

- Fort Worth, TX Property Tax Rates

- Selling Home with Reverse Mortgage

- Selling a Home in Fort Worth, TX, That Needs Repairs

- How to Sell a House with Title Issues in Fort Worth, TX